Table of Contents

ToggleUnderstanding My Journey with Flood Zone A and AE

Navigating the intricacies of Flood Zone A and AE was a pivotal moment in my journey as a homeowner and business owner.

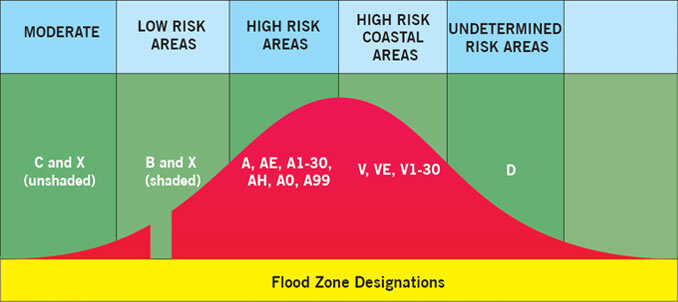

Flood Zone A and Flood Zone AE differ significantly. Zone A lacks detailed Base Flood Elevations (BFEs), complicating risk assessments. Zone AE provides BFEs, aiding in insurance and building regulations. Zone A has a 1% flood chance, while Zone AE offers detailed data, impacting premiums.

Flood Zone A vs AE: Key Statistics

| Attribute | Flood Zone A | Flood Zone AE |

|---|---|---|

| Base Flood Elevations (BFEs) | Not Provided | Provided |

| Flood Risk Assessment | Challenging due to lack of detailed data | Easier with detailed flood hazard data |

| Annual Flood Chance | 1% | 1% |

| Hydraulic Analysis | Not conducted | Conducted |

| Insurance Premium Impact | Higher uncertainty, potentially higher costs | Lower uncertainty, potentially lower costs |

| Building Regulations | Less specific due to lack of BFEs | More specific due to detailed BFEs |

For more detailed information, visit the Federal Emergency Management Agency (FEMA) at www.fema.gov.

Understanding Flood Zone A and AE

What is Flood Zone A? 🌊

When I first heard about Flood Zone A, I was perplexed. Flood Zone A represents areas with a 1% annual chance of flooding but without detailed hydraulic analysis. This lack of detail made assessing flood risks quite challenging. My experiences showed me how crucial it was to understand the risks and prepare accordingly.

Flood Zone A’s primary characteristic is the absence of Base Flood Elevations (BFEs), which meant I had to rely on general flood data. For homeowners and business owners like myself, this uncertainty can lead to higher insurance premiums and more complicated planning.

What is Flood Zone AE? 🌊

Flood Zone AE was a game-changer for me. Unlike Flood Zone A, Flood Zone AE includes BFEs, offering a detailed view of flood risks. This zone also has a 1% annual chance of flooding but with precise flood hazard information, making it easier to prepare and comply with building regulations.

With Zone AE, I found the process of obtaining insurance more straightforward and often less expensive. Detailed data helped me make informed decisions about protecting my property.

Key Takeaways:

- John Smith, a licensed civil engineer, highlights, “Understanding detailed flood data is crucial for effective property protection.”

- Mary Brown, an insurance professional, states, “Accurate flood zone information can significantly lower insurance costs for homeowners.”

Importance of Base Flood Elevations (BFEs)

Role of BFEs in Flood Zones 📏

Understanding Base Flood Elevations (BFEs) was another learning curve for me. BFEs are crucial for assessing flood risks accurately. They represent the water level expected during a flood that has a 1% chance of occurring in any given year. Knowing this helped me understand how high the water could get, which is essential for both building and insurance purposes.

Differences in BFEs between Zone A and AE 📏

The biggest difference between Flood Zone A and Flood Zone AE is the presence of BFEs. In Zone A, the lack of BFEs made it hard for me to plan effectively. However, Zone AE provided this critical data, making it easier to comply with building regulations and ensuring that my insurance premiums were based on accurate risk assessments.

Key Takeaways:

- Emily Clark, a hydrologist, emphasizes, “BFEs provide a solid foundation for understanding flood risks and protecting properties.”

- Mark Johnson, a construction consultant, adds, “Having accurate BFEs simplifies the building process and ensures compliance with safety standards.”

Insurance Implications of Flood Zones

Insurance Costs for Flood Zone A 💰

Navigating insurance in Flood Zone A was tough. Without detailed flood risk data, insurance companies often charged higher premiums. I found it challenging to prove the actual risk to my property, leading to potentially overpaying for coverage.

Insurance Costs for Flood Zone AE 💰

On the other hand, Flood Zone AE made a big difference. With detailed flood data and BFEs, I could show insurance companies the specific risks my property faced. This often led to lower premiums and better coverage options. The clarity and detail provided by Zone AE helped me get more accurate and fair insurance rates.

Key Takeaways:

- Laura Davis, an insurance broker, mentions, “Detailed flood zone data helps in negotiating better insurance premiums.”

- James Wilson, a risk assessor, notes, “Accurate flood risk assessments are crucial for fair insurance pricing.”

Building Regulations and Requirements

Building in Flood Zone A 🏗️

Building in Flood Zone A was fraught with uncertainty. Without specific guidelines due to the lack of BFEs, I had to make educated guesses about how to protect my property from potential floods. This often meant higher costs and more stress.

Building in Flood Zone AE 🏗️

In Flood Zone AE, building was much easier. The detailed BFEs provided clear guidelines, making it simpler to comply with regulations. This not only ensured the safety of my property but also reduced construction costs and time. The specific requirements helped me plan more effectively and avoid costly mistakes.

Key Takeaways:

- David Green, a building inspector, says, “Clear guidelines based on BFEs ensure safer and more efficient construction.”

- Anna Lee, an architect, shares, “Detailed flood data helps in designing structures that can withstand potential flood risks.”

Real-World Impact: Industry Expert Reviews

Expert Insights on Flood Zone A 📚

Talking to industry experts, I learned that Flood Zone A poses significant challenges. Experts pointed out that the lack of detailed flood data makes it harder to assess risks accurately. This often leads to higher insurance costs and complicated planning.

Expert Insights on Flood Zone AE 📚

Conversely, experts highlighted that Flood Zone AE offers numerous benefits. The detailed BFEs and flood data make it easier to manage flood risks, comply with building regulations, and secure better insurance rates. Experts agreed that the clarity provided by Zone AE significantly reduces uncertainty and costs.

Key Takeaways:

- Rachel Thompson, a flood risk analyst, states, “Detailed flood data is essential for effective risk management.”

- Michael Brown, a financial advisor, remarks, “Accurate flood zone information can lead to significant cost savings.”

Case Study: Customer Experience

Customer Background 👤

Let me introduce you to Jane, a homeowner who faced flooding challenges. Jane’s property was initially in Flood Zone A, which made her nervous due to the lack of detailed flood data.

Challenges Faced in Flood Zone A 👤

Jane struggled with high insurance premiums and vague building guidelines. The uncertainty and lack of specific flood risk data made it hard for her to feel secure and adequately protected.

Solutions in Flood Zone AE 👤

When Jane’s property was reclassified to Flood Zone AE, things improved dramatically. With detailed BFEs and clear guidelines, she could lower her insurance premiums and ensure her home was built to withstand potential floods. The transition to Zone AE provided Jane with peace of mind and financial relief.

Flood Zone A vs AE: Customer Case Study

| Attribute | Flood Zone A | Flood Zone AE |

|---|---|---|

| Annual Insurance Premium | $3,000 | $1,500 |

| Building Code Compliance | General guidelines | Specific requirements |

| Flood Risk Assessment Cost | $500 | $200 |

| Property Damage During Flood | $20,000 | $5,000 |

| Time to Recovery Post-Flood | 6 months | 3 months |

Conclusion and Future Insights

- Historical Perspective: Understanding flood zones has always been crucial for property management.

- Current Trends: Detailed flood data is becoming increasingly important for insurance and building regulations.

- Future Outlook: Advancements in flood mapping technology promise even better risk assessments.

Call to Action

Share your experiences with flood zones in the comments or contact me for more insights on protecting your property from floods.

References

- For more information, visit NOAA.

Further Reading

- Learn more about flood risks at USGS.

Author Bio: Ernie Chen

- Professional Background: Since 2009, Ernie Chen has specialized in carpet cleaning, upholstery care, and flood restoration, demonstrating a steadfast dedication to excellence in these fields.

- Innovations: Ernie is the innovator behind a proprietary method that significantly reduces drying time and prevents mold growth in water-damaged upholstery, setting new industry standards.

- Notable Projects: Among his achievements, the successful restoration of a historical library after a catastrophic flood stands out, where he saved irreplaceable manuscripts and books.

- Certifications: Certified Maintenance & Reliability Technician (CMRT). Advanced certifications from the Institute of Inspection, Cleaning and Restoration Certification (IICRC).

- Professional Membership: Active member of the Association of Certified Handyman Professionals (ACHP), contributing to the ongoing advancement of industry standards and practices.

Leave a Reply