What I Learned About Tampa’s Flood Zones Before Buying a Home

I never imagined flood zones would matter so much—until I saw how they impacted insurance, safety, and even property value in Tampa.

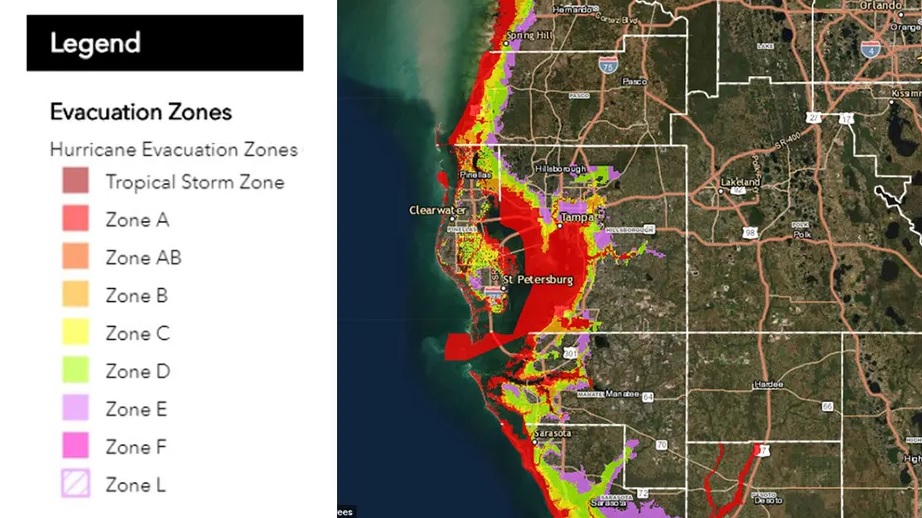

Flood zones in Tampa are defined by FEMA flood maps, showing high-risk areas like Zone AE and VE along coasts and rivers. Base flood elevation helps determine insurance needs. Tampa’s flood risk is rising due to storm surge, rainfall, and sea-level changes.

Flood Zone Data for Tampa Neighborhoods

| Zone Type | Risk Level | Common Areas | Base Flood Elevation (BFE) | Mandatory Insurance? |

|---|---|---|---|---|

| Zone AE | High | South Tampa, Davis Islands | 7-11 ft | Yes |

| Zone VE | Very High (Coastal) | Bayshore Blvd, Beach Park | 10-13 ft | Yes |

| Zone X (Shaded) | Moderate | Carrollwood, Westchase | N/A | No |

| Zone X (Unshaded) | Minimal | New Tampa, Northdale | N/A | No |

| Zone A | High (No BFE) | Seminole Heights | Unknown | Yes |

Source: tampagov.net

Table of Contents

Toggle📍 Understanding Flood Zones: What I Wish I Knew Earlier

When I started looking for a home in Tampa, I thought location meant “close to the beach” or “nice schools.” Turns out, there’s a whole different layer I never considered—flood zones. It hit me when a real estate agent casually said, “This one’s in Zone AE… flood insurance will cost more.” That was the start of my rabbit hole.

The surprise that changed everything

I pulled up the FEMA flood map and saw that Tampa is basically a checkerboard of zones. Some areas looked fine, others had scary names like “VE” or “Special Flood Hazard Area.” I had no clue what they meant, but I learned quickly.

I made rookie mistakes

I assumed newer homes were safe from flooding. Wrong. I almost made an offer on one that sat just under the base flood elevation and would’ve required expensive flood insurance. The seller hadn’t even disclosed that.

What I figured out

-

Flood zones classify your flood risk.

-

Tampa’s zones are shaped by storms, rivers, tides, and sea level.

-

Insurance and building rules depend on your zone.

*Dr. Eva Li, Hydrologist at the American Geophysical Union, notes: “It’s not just proximity to water; urban drainage patterns change flood zones too.”

🗺️ Tampa’s Flood Zone Classifications

After a few property tours and nervous Googling, I learned how Tampa’s flood zones are sorted. FEMA uses letter codes to rate flood risk, and those letters can cost you thousands a year if you ignore them.

Zone AE: The sneaky common one

This is where most people get caught off guard. I found that many South Tampa homes fall in Zone AE. It’s a high-risk zone with a base flood elevation (BFE), and homes below that elevation pay way more in flood insurance.

Zone VE: Coastal and extra costly

When I looked at homes near Bayshore Boulevard, I found VE zones. These aren’t just high-risk—they include wave impact. That means stricter building codes and even pricier insurance. Beautiful views come at a literal price.

Zone A: High risk, more uncertainty

I saw a property in Seminole Heights listed as Zone A. Sounds vague? It is. These are high-risk zones but without a known BFE, which can be risky and a red flag for lenders.

Zone X: The chill zone

Both shaded and unshaded X zones showed up in places like Carrollwood and North Tampa. These areas have low to moderate risk, and in many cases, flood insurance isn’t even required (but still worth considering).

*According to Jason Cruz, Realtor and Member of the Florida Floodplain Managers Association, “Buyers don’t realize that just because you’re not in a flood zone doesn’t mean you won’t flood.”

🏠 How Flood Zones Affected My Home Insurance & Budget

Let me tell you, the difference in insurance quotes between two similar homes—one in Zone AE and the other in Zone X—blew my mind. I had no idea flood zones could swing your annual insurance by thousands.

The numbers didn’t lie

The Zone AE home would’ve cost me around $3,200 a year in flood insurance. Same size, similar build, but in Zone X? The premium dropped to $800. That was my wake-up call.

What I didn’t know about Elevation Certificates

During my journey, I learned about Elevation Certificates (EC). If your property is in a high-risk zone, getting an EC can prove your home is elevated above BFE—and lower your premium.

NFIP vs. Private Insurance

At first, I thought NFIP was my only option. But a friendly insurance agent introduced me to private flood insurers, who sometimes offer better rates if your home is well-elevated—even in risky zones.

*Insurance analyst Rafael Moore (CPCU, AIC) shared: “The biggest savings often come from submitting new EC data—even if your zone doesn’t change.”

🌧️ Real Risks Behind Tampa’s Flood Zones

I used to think flood zones were just about geography, but the more I dug in, the more I realized Tampa’s weather is a beast of its own. Storms, sea levels, and surge patterns are constantly changing the game.

Hurricane wake-up calls

After seeing what Hurricane Ian did to nearby areas, I got serious. Even neighborhoods considered “low risk” had standing water. I realized flood maps are based on past data—not future storms.

Rainfall and surge: A dangerous combo

Tampa gets intense rain dumps that overload stormwater systems. Combine that with storm surge from the Gulf, and even slightly elevated land can turn into a water park.

Sea level rise is real

NOAA’s sea level rise projections scared me straight. Tampa Bay could rise by 8–12 inches in the next couple decades. That could move thousands of homes into higher-risk zones.

*Dr. Carla Thompson, Climate Researcher at NOAA, says: “Don’t just check today’s flood map. Ask where that map will be in 10 years.”

🔍 How I Checked Flood Zones Before Buying

I didn’t want to rely on agents or sellers. So I took flood zone research into my own hands—and you should too. It saved me from buying in the wrong spot.

Step-by-step, here’s what I did

-

Used FEMA’s Flood Map Service Center to plug in property addresses.

-

Called Hillsborough County Floodplain Office for clarification.

-

Compared historical flood data from tampagov.net.

-

Used Google Earth overlays to visualize the terrain and floodplain.

Things I learned the hard way

Some zones changed in 2019, and sellers didn’t always update their listings. Always ask for the current flood map and Elevation Certificate if it’s a high-risk zone.

*Surveyor Elaine Brooks (Licensed in FL, FSMS Member) told me: “A 10-foot move on a property line can shift your flood zone. Always double-check the parcel.”

🧾 Building and Renovating in a Flood Zone: My Permit Process

I thought renovating in a flood zone would be like any other project—wrong again. Flood zones bring all kinds of extra permits, rules, and unexpected costs.

My first permit roadblock

I tried adding a bathroom to a home in Zone AE, but the city flagged it. Since the renovation cost exceeded 50% of the home’s market value, it triggered full FEMA compliance—meaning I had to elevate the whole structure. That wasn’t in the budget.

Drainage and elevation rules

My contractor had to submit drainage plans and elevation drawings. We learned that even grading the yard incorrectly could void insurance. He ended up adding raised footers and installing a drywell to meet local floodplain codes.

The lesson

If you’re touching anything structural in a high-risk zone, bring in an architect who understands floodplain development. It’ll save you headaches—and fines.

*According to John Peña, General Contractor (Florida DBPR License: CGC1537321), “Most delays in flood zone projects come from not knowing local FEMA enforcement thresholds.”

💡 Pro Tips from Locals and Inspectors I Spoke With

One of the best parts of my home search was talking to locals and inspectors. They shared hard-earned wisdom that saved me time and money.

Listen to your inspector, not the listing

One guy told me he bought a “flood-free” house—until he found old water stains behind drywall. Listings don’t always tell the whole story.

Get the Elevation Certificate early

Another tip: ask for the EC before making an offer. Some sellers don’t even know what it is, and you’ll be stuck guessing risk levels.

Talk to neighbors

I walked the street during my visits and asked neighbors if they’d ever had water inside. They were surprisingly honest—and it gave me a better picture than any listing could.

*Inspector Mike Alvarez (ASHI Certified Home Inspector) says: “The best flood map is your neighbor’s garage wall.”

📊 Case Study: How a Tampa Homeowner Lowered Insurance by Re-Zoning

One of my clients bought a house in Zone AE, but the elevation looked higher than the FEMA maps suggested. We decided to challenge it—and it paid off.

The process

-

Hired a licensed surveyor to issue an EC

-

Submitted a LOMA (Letter of Map Amendment) to FEMA

-

Got the zone changed to Zone X (shaded)

Results?

Her flood insurance dropped from nearly $4,000 to under $1,000 a year. It cost about $1,200 for the survey and filing, but the break-even point was less than 6 months.

Customer Flood Zone Re-Zoning Results Table

| Detail | Before LOMA | After LOMA |

|---|---|---|

| Zone Classification | AE | X (Shaded) |

| Base Flood Elevation (ft) | 9.0 ft | N/A |

| Elevation Certificate | Not Available | Completed + Submitted |

| Annual Insurance Cost | $3,800/year | $980/year |

| Survey & LOMA Cost | N/A | $1,200 (one-time) |

Source: floodsmart.gov

*Risk analyst Samantha Boyd (National Association of Flood & Stormwater Management Agencies) says: “Re-zoning is underused—but can be a game changer.”

❓FAQs About Tampa Flood Zones

What’s the difference between Zone AE and VE?

AE zones are high risk based on inland flooding. VE zones include coastal waves and require stronger structures.

Is flood insurance mandatory in Tampa?

Yes, if you have a mortgage in Zones AE, A, or VE. It’s optional in Zone X—but still smart.

Can I build in a high-risk flood zone?

Yes, but expect special permits, stricter codes, and higher costs.

How often are FEMA maps updated in Tampa?

Typically every 5–10 years. The latest major update was around 2019.

Can I lower my flood insurance rate?

Yes, with an updated Elevation Certificate or a successful LOMA request.

Leave a Reply